Agricultural land:

a stable, inflation-resistant

asset with steady growth

Uncorrelated to stock markets. Low volatility.

Portfolio diversification.

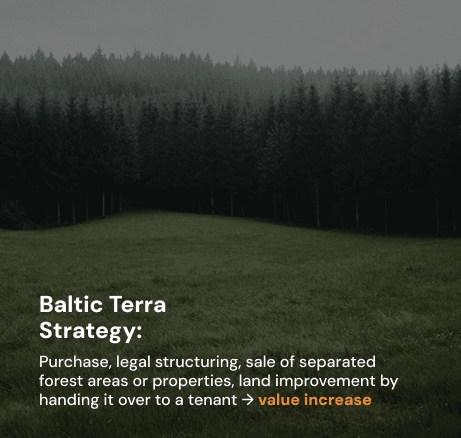

Our 3-Step Strategy:

Buy, Add Value, Manage

1

BUY

- We acquire land based on soil, climate, and water availability — targeting 35M EUR

worth of high-potential assets.

2

ADD VALUE

- Legal clarification and segmentation of forests/buildings

- Organic certification and crop rotation

- Infrastructure investments (roads, drainage, water access)

3

MANAGE

- Part of the land is leased to major producers; part is managed in-house

- Optimization via data tools and precision agriculture

Smart AgTech

-

Satellite monitoring — Tracks soil health and moisture for timely,

targeted interventions. -

GPS-based farming — Enables precise sowing, fertilisation, and

cultivation, reducing waste and boosting yields. -

Drip irrigation — Delivers water efficiently to roots, minimizing loss

and conserving resources. -

Real-time data management & farm software — Streamlines

operations with live data, reporting, and smart decision-making.

more reliable lease income and higher long-term land value.

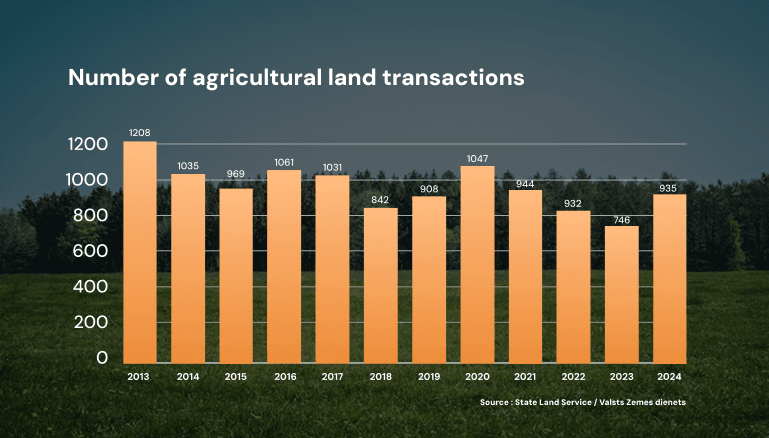

Market Dynamics

Regional Profit Potential

Dual Return Model:

Consistent lease-based income from agricultural operations with long-term capital growth through strategic land value appreciation. By acquiring undervalued or misclassified land, where farmland remains significantly underpriced compared to Western Europe—the fund enhances its productivity or legal status, generating stable cash flow while positioning for revaluation gains. This approach offers both reliable yield and potential upside, driven by market inefficiencies and evolving land use classifications.

transactions EUR/ha

land in the regions, EUR/ha (2024)

Average annual rental price of agricultural land:

200

EUR/ha

Average price

300

EUR/ha

Highest agricultural land rent

in Latvia in 2024

Case Study:

before and after

Before:

-

40 ha overgrown land +20 ha forest +

abandoned homestead - Legal encumbrances

- Price: 1 850 EUR/ha

- Total Value: 148 000 eur

After:

- Legal clean-up and segmentation

-

Lease contracts are concluded

with farmers -

Forest and buildings sold separately

(ROI: +50%, +2,000%) - Land leased with high liquidity

- Expected ROI after 1 year: + 50%

Make a Difference - For the World

and Your Portfolio

Choose a partner that blends capital growth

with environmental value